April 2025 may go down in Tesla’s corporate history as the tipping point—when long-simmering tensions between the company’s controversial CEO Elon Musk and its disillusioned investor base spilled into the open. And at the center of that storm now stands Ross Gerber.

Once a vocal cheerleader for Musk’s vision, Gerber, CEO of Gerber Kawasaki Wealth and Investment Management, has transformed into the loudest voice demanding sweeping leadership change.

Following a brutal 71% profit drop in Tesla’s first quarter of 2025 and a volatile earnings call that raised more questions than it answered, Gerber has emerged not just as a critic, but as a de facto leader in what is quickly becoming a full-blown shareholder revolt to “rescue Tesla from Musk himself.”

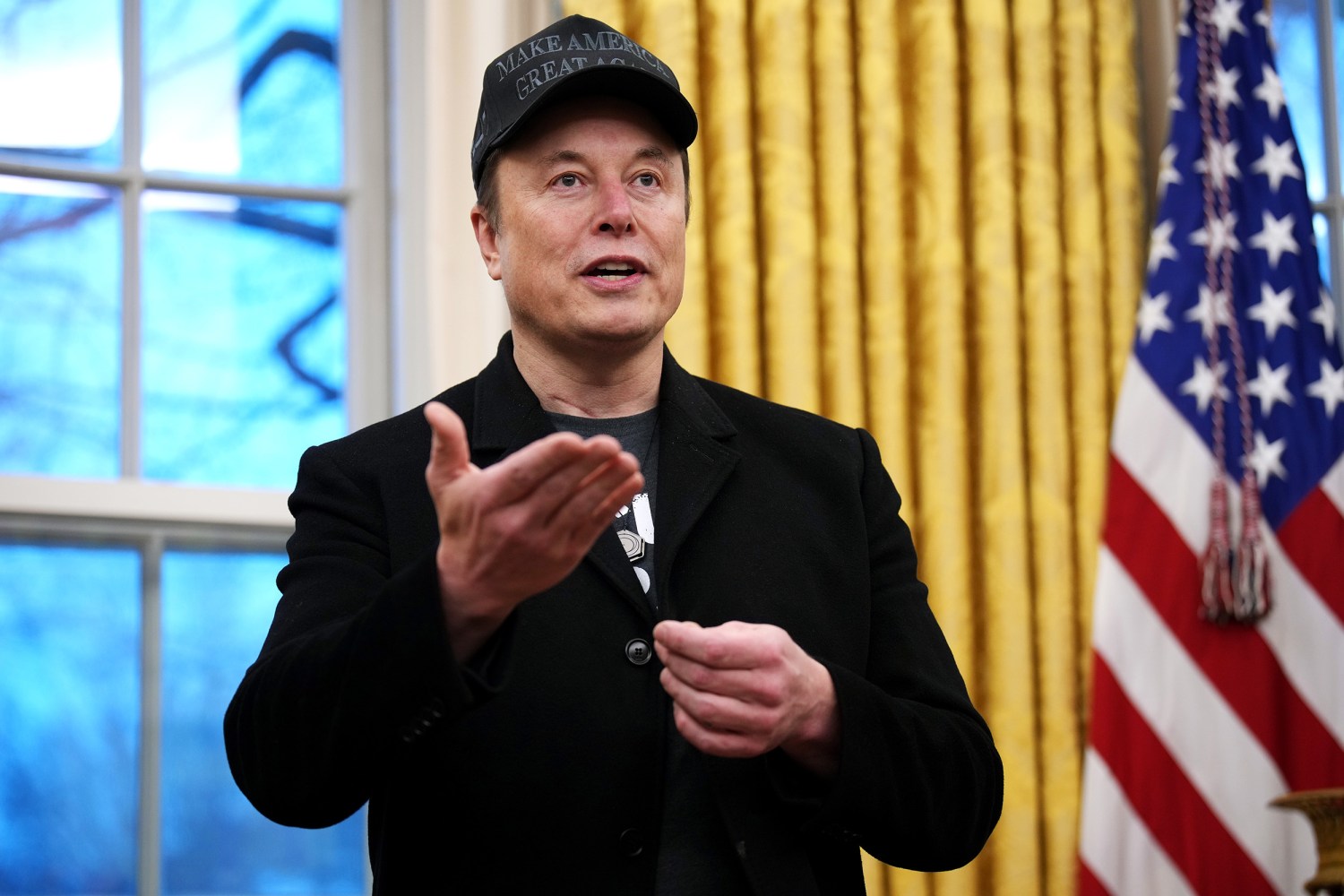

Tesla’s Q1 report delivered a body blow to investor confidence. The company’s profits dropped precipitously from $1.39 billion to just $409 million, igniting fears about long-term viability and the impact of external distractions—most notably Musk’s ongoing involvement in Washington as head of the Department of Government Efficiency (DOGE) under President Donald Trump’s administration.

Tesla’s stock, already down 37% year-to-date, had become a symbol of what many investors perceive as Musk’s increasingly split focus, volatile leadership, and risky bet on futuristic products that lack tangible short-term value.

The earnings call, intended to provide reassurance, instead deepened investor concerns. Ross Gerber, who owns over 250,000 shares in Tesla as of March 2025 and once controlled a stake valued over $60 million before dumping a significant portion in late 2024, described the call as a breaking point.

In a phone interview with Newsweek, Gerber stated he was “trying to figure out if Elon Musk actually does anything at Tesla at all,” adding that Musk’s supposed return to the company felt like “false hope.” The most damning part of the call, according to Gerber, was Musk’s awkward and vague explanation about Tesla’s upcoming robotaxi, dubbed Cybercab, which is supposedly set to launch in Austin, Texas, later this year.

“Everything was pretty standard Elon gibberish through the first part of the call with the same promises and false statements that he normally makes,” Gerber said. “But then the questions got to robotaxi, and that’s when I got spooked. It was a simple question and it turned into him stuttering for 10 minutes.”

When Musk began comparing vehicle cameras to human eyes and claiming that Tesla cars would mimic biological perception with “eight eyes,” Gerber’s reaction was blistering.

“You have no ears. You have no touch. You have no smell. You have no intuition. You’re nothing like a human. If you think a camera is anything like your eye, you don’t know the first thing about biology. It’s infuriating,” he said.

The tension between Tesla’s future roadmap and investor expectations is becoming irreconcilable. While the company remains committed to expanding its AI and robotics divisions, as stated in the Q1 earnings report, investors like Gerber are growing tired of grand promises and are demanding execution, not speculation.

Tesla’s report itself acknowledged that “uncertainty in the automotive and energy markets continues to increase,” citing volatile trade policy and shifting political sentiment as major headwinds. Yet many in the financial community believe the greatest threat to Tesla’s market position is internal: an overstretched CEO who continues to divide his time between multiple high-stakes ventures.

Musk’s role at DOGE, which he used during the call to justify his absence and diminished presence at Tesla, has been particularly controversial. “The DOGE team has made a lot of progress in addressing waste and fraud,” Musk said. “But the natural blowback from that is those who were receiving the wasteful dollars and the fraudulent dollars will try to attack me and the DOGE team and anything associated with me.”

While Musk framed these attacks as politically motivated, shareholders like Gerber are far less sympathetic. They argue that Tesla has become collateral damage in Musk’s political crusades and that the CEO’s external engagements have undermined the company’s core mission.

Musk has pledged to “allocate far more of my time to Tesla” starting in May, indicating that he will reduce his government workload to just “a day or two per week.” While some analysts, such as Dan Ives of Wedbush Securities, have cautiously welcomed this pivot as a “step in the right direction,” others believe it falls drastically short of what’s needed to stabilize the company.

For Gerber, it’s not just about time allocation—it’s about accountability. He believes Musk’s attention has shifted permanently toward ventures like xAI, and that his commitment to Tesla is now more symbolic than substantive.

Tesla’s brief 6% stock rebound on Wednesday did little to blunt investor frustration. For many, the gains were seen as a temporary relief rally, not a reversal of fortune. The underlying sentiment on Wall Street remains grim: without serious leadership reform, Tesla risks losing its position at the top of the EV sector, especially as competitors like BYD surge ahead in both innovation and delivery volume.

Gerber has long championed Tesla’s mission, but his recent tone has shifted from criticism to confrontation. He has openly called for the Tesla board to initiate the process of replacing Elon Musk as CEO, or at the very least, to pressure him into stepping aside until he can fully recommit to the role.

He has argued that Tesla’s governance structure has failed to protect shareholders and that board complacency has allowed Musk to operate without meaningful oversight.

Some Tesla insiders now whisper of an emerging “Gerber coalition,” a growing bloc of institutional investors and influential voices pushing for board reform and a change at the top. Though no formal proxy fight has been initiated, the pressure is mounting.

Should the board fail to act, activist investors may soon take matters into their own hands, potentially triggering a rare and contentious leadership showdown at one of the world’s most closely watched companies.

The stakes could not be higher. Tesla is navigating a moment of acute transition, not just in terms of leadership but in terms of its technological ambitions, regulatory risks, and global market position.

While Musk’s legacy as the architect of the EV revolution remains undisputed, that legacy now hangs in the balance. If Tesla falters further, it won’t be because of external forces or geopolitical pressures—it will be because the company failed to adapt internally, clinging too long to a leadership style that no longer serves its evolving needs.

As Gerber steps forward to lead the charge, the message from investors is clear: it’s time to choose between the mythology of Elon Musk and the future of Tesla. If the board cannot or will not make that decision, shareholders just might.